Digital transformation is creating massive buzz across insurance technology blogs, tech pundits on twitter, and more importantly inside insurance company board rooms and C Suites. Vendors are piling in offering leapfrog solutions to help insurers become digitally savvy – and delight their customers. Senior executives are adding digital transformation to their “must do now” agenda.

However, many insurance providers, including the biggest industry heavyweights are still struggling with the workflow processes and the IT infrastructure behind the “currency” of their business – documents.

To manage these documents you need specialized systems that allow for storage of binaries and rich indexes. These costs can be astronomical, and stop these “must do now” initiatives in their tracks. Most ECM systems charge a hefty per seat fee. As user activities increase, the number of users rises, and of course, so does the cost. Besides costs, the other challenge is “content chaos.”

With the rapid uptake of consumer’s demanding the Uber/Starbucks experience on their phones the chaos will only get much worse. LTI, a 20-year global technology consulting firm specializes in creating digital solutions for insurance. According to Nilesh Lohia, principal consultant, P&C Insurance at LTI, “There has been a proliferation of data because of increasingly digital ways of doing business. Most carriers have not been able to build capabilities to capture, standardize and analyze data.”

Documents Create More Silos

Offices that were supposed to go paperless two decades ago are still dealing with paper, scanning them when received and emailing or faxing them around.

And this is just the tip of iceberg.

“The data proliferation trend is expected to exponentially grow as insurers look at tapping the data collected from web, social media and sensor devices. Unprepared insurers face the risk of being uncompetitive in the marketplace which could drive de-growth,” adds Lohia.

They are far away from achieving digital transformation. Indeed, we consider the latter being a journey and one of the key steps is implementing an effective content management system.

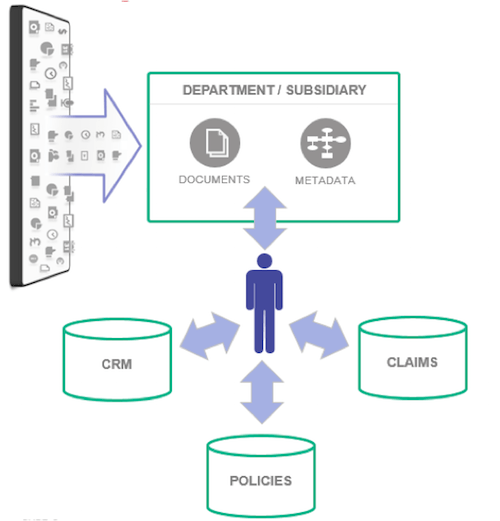

“The challenge is document management systems or content management systems are varied and in most cases are siloed infrastructures across Claims, Policy and Customer facing applications, says Bill Fox, Insurance and Healthcare CTO at MarkLogic. “Ironically, few of these systems can actually be called enterprise content management platforms.”

According to Gartner (http://www.gartner.com/it-glossary/enterprise-content-management-ecm), Enterprise content management (ECM) is used to create, store, distribute, discover, archive and manage unstructured content (such as scanned documents, email, reports, medical images and office documents), and ultimately analyze usage to enable organizations to deliver relevant content to users where and when they need it.

Why ECM Projects Fail

However, the insurance landscape is littered with failed ECM projects because they are too hard to use, which leads to non-compliance by users resulting in systems full of documents that nobody can find or use to drive business strategy and consumer experience. Today’s Enterprise Content or Document Management system must be able to:

- Extract business value requires different approaches. Consider the time your data scientists spend on analyzing data. A Wall Street Journal article states that data scientists spend 80 percent of their time loading and shaping data instead of actually doing analysis; the right technology can enable your organization to significantly increase the efficiency of your data science teams, freeing time for value-add activities such as predictive analytics. Read more about achieving a holistic view on your Customers, Risk and Operations in our Insurance 360 white paper.

- Data security. Far-reaching breaches and hacks have put security at the top of the MUST pile. Conventional wisdom would suggest that outsider attacks are the prime culprit, but according to the SANS Institute, almost half (46 percent) of security breaches are from the inside. You can read more about our recommended approach to Data security in a related blog Cybersecurity: Shifting Focus to Insider Threats, Locking Down Data

- Compliance requests. For example, your compliance and risk management team should be able leverage an ECM to answer questions like “Would a claims adjuster modify a payments schedule based on new updates to the property & casualty database after assessment by a disaster management agency? Are these underwriters involved in a money laundering network? Is the provenance of these premiums clear enough to guaranty they are not part of a terrorism funding system?” Read more about regulatory compliance in Insurance, financial and Energy markets in a related white paper.

Amit Unde, CTO Insurance LTI, offers the following. “Insurance companies therefore need to adopt solutions around a new electronic content management system that will analyze data across structured and unstructured sources, and present meaningful insights for faster and accurate business decisions. The convergence needs to happen before the user experience layer,” he says. “Finding the needle of insight in the data haystack should become second nature for the business users. Employee talent can then be focused on solving strategic business issues.”

This is the first in series of blogs focused on redefining enterprise content management in the Insurance market. Next: Find out why Insurers are living in a document hell — and what you can do about it.

Anastasia Olshanskaya

Anastasia Olshanskaya is MarkLogic’s solutions marketing manager for Financial Services and Insurance, looking after the messaging strategy and content creation. A linguist and marketeer, Anastasia has 15 years of experience in global marketing and communications roles in financial and media companies, such as Euromoney Institutional Investor and Thomson Reuters in the UK and France.