Behind the Deal: How Relationships and Trust Played a Key Role in Our Acquisition of ShareFile

Here’s another post in the Progress M&A blog series, this one about the importance of relationships and trust in closing successful deals.

The Progress Total Growth Strategy has three pillars: Invest and Innovate, Acquire and Integrate, and Drive Customer Success. Our Acquire and Integrate pillar centers around our commitment to driving customer value by making strategic acquisitions of complementary technology. Such was the case with our acquisition of ShareFile from Cloud Software Group. The deal was a testament to the importance of strong personal relationships when sourcing—and ultimately closing—transactions.

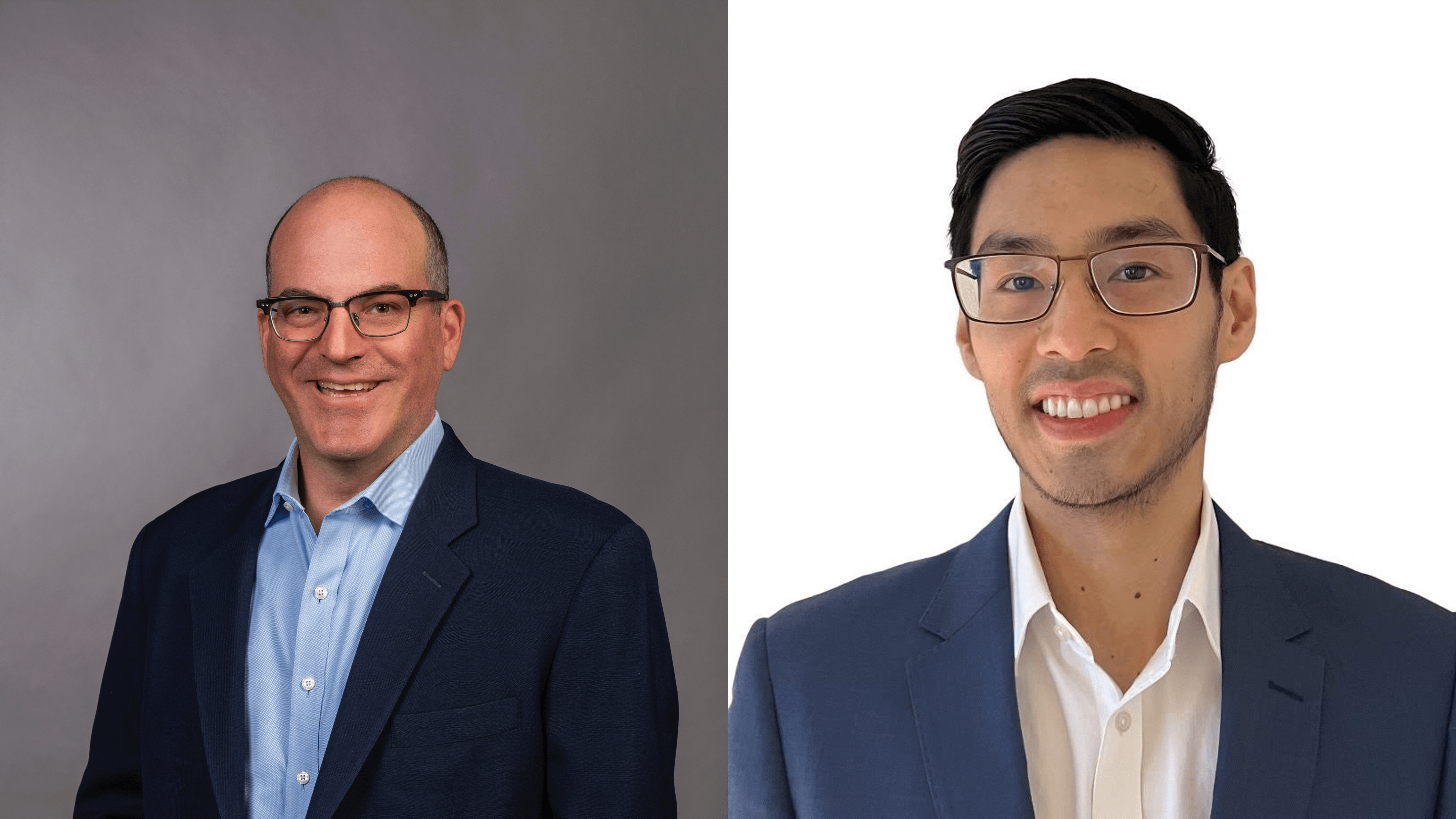

After the transaction closed on October 31, we sat down to discuss the deal with two instrumental players: Ric Chi, Cloud Software Group Vice President, Corporate Strategy and Jeremy Segal, Progress Executive Vice President, Corporate Development.

Progress: Jeremy, why don’t you kick us off and share how the deal came to be?

Jeremy: Our corporate development team puts significant effort towards building relationships. We recognize the importance these relationships can play. With bankers, it is important for them to understand our financial criteria and think of Progress when they are selling assets—and hopefully, give us an early look. Next, we want CEOs who are considering selling to put Progress on the short list of suitors. Finally, close relationships with Venture Capitalists (VCs) and private equity firms (PEs) help keep us top of mind when they decide to sell their portfolio companies.

In the case of Cloud Software Group, Ric and I had developed a strong relationship over several years, originating during his days leading corporate development at Broadcom, and then continuing in his current role at CSG. When Cloud Software Group decided it wanted to sell its ShareFile business, given our ongoing conversations with both the company’s CEO, Tom Krause and Ric, we were on the list when the investment bankers began their outreach. Our strong connections with these bankers, together with our proven acquisition success, ability to assure speed and certainty to close, and the clear strategic rationale positioned us well in this competitive transaction.

Progress: Every deal has its challenges, such as tight timelines and due diligence questions. How did you overcome those?

Ric: Jeremy and I have had a consistent dialogue going back many years. Through that, I had a chance to know and appreciate the Progress acquisition strategy. This enabled us to establish a common understanding, which was extremely helpful during due diligence. Between product diligence, business diligence and financial diligence, there are a lot of conversations happening at the same time. Having a foundation of trust added a level of efficiency to the process that played a strong role in the deal’s outcome.

Progress: How did knowing Ric play a role in the initial vetting?

Jeremy: It was incredibly valuable. There are so many moving parts to a deal during diligence, and this creates ample opportunities for information bottlenecks. Strong relationships and having an internal advocate enabled us to cut through some of those delays and get issues resolved so the diligence work could continue at a faster clip. The ability to close deals quickly is a strategic advantage for Progress, but in order to do so, we need to fulfill our critical diligence requests, and maintaining a strong relationship with Ric allowed us to do this.

Progress: Do you agree that good working relationships help in vetting?

Ric: Absolutely. They keep communication flowing and can simplify the process of establishing what’s important to both sides. Of course, our deal teams play a huge role here in helping to drive through challenges. But being able to cut through the tension and avoid misunderstandings through effective communication at the deal lead level is particularly important. It also helps to keep our respective leadership teams aligned and informed, which can facilitate a faster resolution.

Jeremy: Yes, it can greatly accelerate getting answers. Information that could be bottlenecked for an extended period of time can be obtained quickly. Issues that can linger can be resolved fast if you know—and trust—your negotiation partners.

Progress: Were there other interested parties? How did Progress emerge as the frontrunner?

Ric: There was meaningful interest in ShareFile, including Private Equity and other Strategics, but Progress stepped forward as the winner for several key reasons. The team knew the industry, spent time understanding the ShareFile-specific value creation opportunity and had been very thoughtful in creating a targeted diligence process. Progress customized and prioritized its diligence asks for this deal, so it was easy to see Progress had a solid foundation. Going back to effective communication, our ability to speak the same “deal” language allowed us to minimize miscommunication and close out issues with one conversation as opposed to multiple. That was critically important to the deal’s success.

Progress: So, integration planning really begins during diligence?

Ric: Yes. But when you are doing deal diligence, you don’t want to slow that down by doing too much integration planning. That can be done later. There’s a tricky balance to doing both at the same time without making it seem that way. Asking thoughtful questions in the right way can serve both purposes and drive an efficient diligence process, while setting up well for integration planning. I’ve noticed that Progress strikes this balance well.

Progress: What advice do you have for other corporate development professionals?

Ric: Building quality relationships in any career is important, but especially in our field and not just with other corporate development professionals— this also includes with target company CEOs, investment bankers, VCs and PEs that invest heavily in your space. You never know where your next deal is coming from or who your next counterpart will be. So, investing time and effort into building strong relationships will put you in a better position to find the next deal and succeed in driving impact through your work.

Progress: Jeremy, any final thoughts to add?

Jeremy: One thing I would like to add is the importance of being prepared. If we began our ShareFile conversations and didn’t understand what the product did or how the company would fit into the Progress portfolio, we would have left Cloud Software Group scratching their heads. As Corporate Development professionals, we need to be thoughtful and understand as much as we can about a business in advance of engaging with them. We need to communicate why it’s a strategic fit for our business. Our ability to articulate our knowledge and passion for bringing ShareFile into the Progress portfolio was very important in bringing this deal to fruition.

Paulette Stout

Director, Brand Marketing

Progress Director of Brand Strategy, Paulette Stout, is an enthusiastic champion of the written word and all things Progress Brand. She has a strong background in content marketing, writing and strategy, and was also an award-winning media buyer-planner for top brands. She's also a published author of four novels.